- Flag Breakout on weekly charts with expected target of 35% in next few months.

- 13wMA above 20wMA and 20wMA above 50wMA and all these MA are above 100wMA - Positive for short and medium term.

- Support near 50wMA 2460.

Join Our Free Telegram group

- Kitex Garment Stock is in downtrend for long term but has taken support from 200-190 range multiple times during last 1 year.

- Stock is making descending triangle pattern and require a breakout for any major move.

- On Friday stock made Bullish Engulfing Pattern from supporting range. We are expecting the positive trend to continue.

- Minor resistance 207-12-20, Major resistance 240. Support below 190 are 180-63-50.

Join Our WhatsApp group

- Longs were advised to clients/Followers when stock was at 192-92 last week (Option Trade No.10 dated 11.11.2022) now stock has completed our first target 197.

- Stock is looking good for targets of 215 (10%) as has given neckline breakout from inverted head and shoulder on daily chart.

- Stock has crossed and sustained above 50dMA indicating further upside. Short term (13dMA) has shown cross over above 20dMA.

- Descending triangle pattern breakout on weekly chart.

- Indicators -ADX on daily chart. RSI, William %R on weekly chart showing fresh buying interest.

To Join our qoohoo group click on the link below

- Jupiter wagons is a newly listed company and it's stock is performing great since listing.

- On daily chart a Cup and Handle Pattern breakout is visible. with expected targets of 20% and above from neckline breakout level.

- Support exists at 76 while best entry will be on sustaining at 82.

- Technical indicators William % R, RSI are in buying mode

Open IIFL demat Account

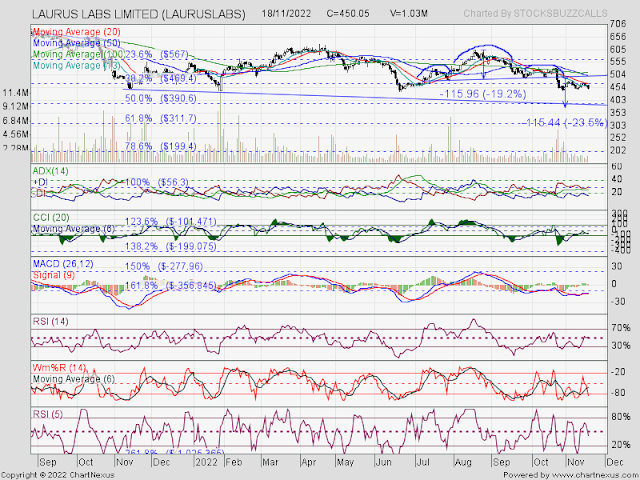

- With all pharma sector stocks this stock is also in downtrend.

- Stock is taking support around 440 but when we check chart pattern on last 6 month chart it is easily visible that a head and shoulder pattern neckline breakdown has already happened and once stock breaks 440-35 (previous low) another decline of 10-15% is on cards.

- Technical Indicators RSI(5), William %R , ADX are indicating further weakness in stock.

- 20dMA cross over above 13dMA and 100dMA cross over above 50dMA indicating weakness to continue for some more time