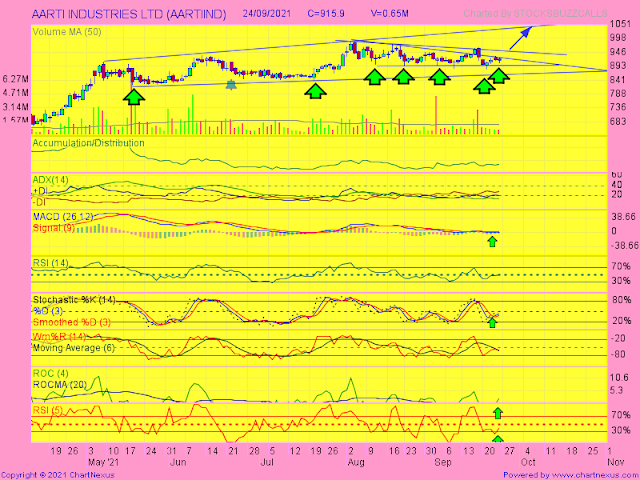

Aarti Ind

Stock is looking good on charts and can test 947-962, once sustains above 930. However major breakout on charts will be above 965 for sharp move towards 1000-1050. Stoploss can be placed below 900.

Stock is facing resistance around 59-61 while support exists around 53.5, below that we expect stock to test 50-47. Use dips to add with stop below 44.In case of sudden upmove trade long only above 61, till you can use rallies to short.

Stock was in downtrend for last few weeks and trading below all major long and short term moving averages, but now looks like getting some support around 315-20 and have also made double bottom near 315, so start accumulation here and add more once stock surpasses resistance range of 326-31 for targets of 360-400 in coming days.

IBULHSGFIN

Stock is in downtrend for last 3 months and has already corrected significantly from the highs of 313+ to 207. Start accumulation and use dips to add more till 190 with stoploss below 185. If moves above 240 we expect stock to test 262 in short term.

NMDC

From

the highs of 213 made during May 2021 now trading around 133 & has already

retraced more than 50% of its previous rally from 61 to 213. At current price stock

seems to be getting some support thus we expect it to move up further till it

is holding stoploss 133. Add for 154-62 in coming days. Below 133 we expect to test stock 123-19.

SAIL

Stock is in downtrend for last 4-5 months and still no sign of relief, but on dips, we expect stock to get support around 106-100 and 92 so start accumulation on dips where short term traders can keep stoploss at 99 (below 200dMA) and for investors stoploss will be 90 (below 50wMA). We expect stock to test 124-36-45 in coming weeks.

LICHSGFIN

Stock is facing resistance around 440-50 on daily charts, while support exists around 415-405. On weekly charts the stock is looking good with bullish engulfing pattern. Use dips to add for medium target of 600. Stoploss can be placed at 400, below which major support is at 360.